Connect With Us

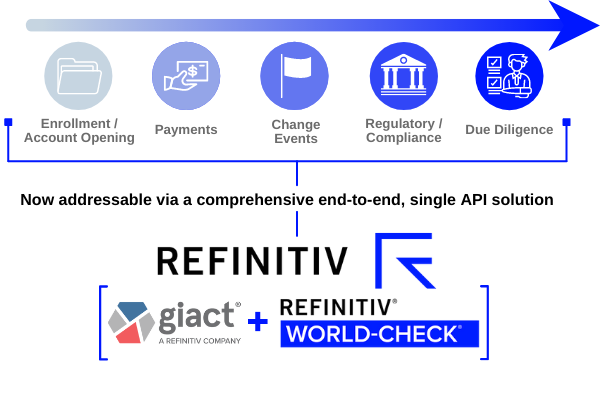

Refinitiv Introduces End-to-End, Single API Solution to Address the Customer Lifecycle

Criminals have become well-funded, well-organized and more effective at deploying sophisticated fraud tactics and hiding illicit funds. For more than a decade the industry has been calling for a solution to address the converging risks that span identity, payments, and suspicious activity.

To answer the call, Refinitiv announced the availability of World-Check and GIACT's EPIC Platform®.

The combined, single API solution provides the unprecedented capability to address all manner of consumer and business identity, payments, and compliance risk across the customer lifecycle.

The solution represents a truly holistic approach to fraud and risk that spans enrollments/account openings; payments; change events; regulatory and compliance; to ongoing KYC and due diligence.

The result is a comprehensive solution that eliminates gaps in the fraud prevention process; helps protect financial institutions, businesses, government entities and others against the latest fraud threats; and improves user experience by delivering a multi-dimensional view of consumer and business identity and associated account risk, all in real-time.

From reducing false positives during account openings to providing real-time, fact-based decisioning, Refinitiv empowers organizations to attract and retain customers, safeguard their reputation, and protect their supply chain and vendor relationships while removing friction and elevating customer experience.

Benefits

Mitigate risk across the customer lifecycle via a single API

- Manage risk and mitigate fraud across the customer lifecycle – from enrollment, payment, change event, to ongoing due diligence and KYC compliance – via a single API

Proactively identity both traditional and emerging risks

- Proactively identify and mitigate both traditional and emerging risks (e.g., identity and vendor fraud; money laundering, bribery and corruption; enforcements and fines) as well as address newer, more sophisticated fraud threats (e.g., synthetic identity fraud; account takeover; business email compromise)

Address fraud and risk throughout the organization

- Unlike point solutions, Refinitiv’s single API can be integrated throughout an organization, across departments to mitigate all manner of fraud and risk

Improve customer experience

- Attract and retain customers by helping to safeguarding their reputations and protecting supply chain and vendor relationship; improve customer experience by minimizing friction while reducing fraud and risk

Completely customizable

- Customization means you can build a service package that’s right for you

Eliminate faulty point solutions

- Eliminate the need for point solutions that fail to address each stage of the customer lifecycle and that can’t keep up with today’s fraud environment; consolidate vendors by building a solution that is connected through a single API

How It Works